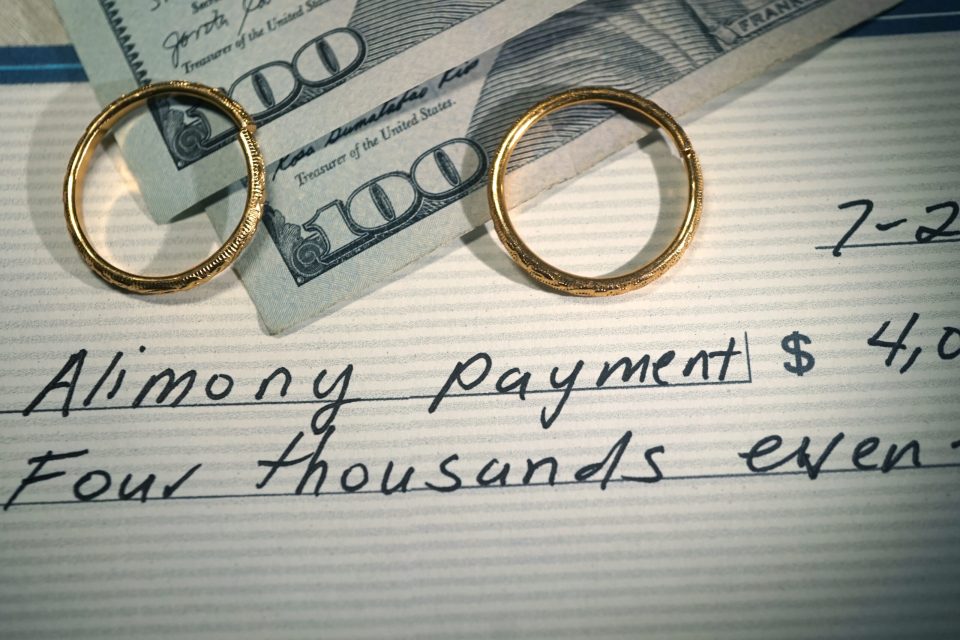

What Is Spousal Support?

Spousal support, commonly referred to as alimony, is a financial payment from one spouse to another following a divorce. Its purpose is to provide temporary or long-term financial assistance to help maintain a reasonable standard of living. In Massachusetts, spousal support is determined based on multiple factors, including the length of the marriage, income and earning potential, standard of living during the marriage, and the needs of both parties.

For Boston residents navigating divorce, understanding spousal support is essential because these obligations can significantly impact post-divorce financial stability. Whether paying or receiving support, careful planning ensures that long-term goals remain achievable and that day-to-day financial responsibilities are manageable.

How Spousal Support Is Determined in Massachusetts

Massachusetts courts consider several factors when establishing spousal support obligations:

- Length of Marriage: Longer marriages often result in extended support payments. Shorter marriages typically lead to temporary or limited support.

- Income and Earning Capacity: Courts evaluate both the paying spouse’s income and the receiving spouse’s ability to earn. Potential future earning capacity, along with current earnings, is a key consideration.

- Standard of Living During the Marriage: Support is designed to help the receiving spouse maintain a lifestyle similar to what was experienced during the marriage.

- Age and Health: Older individuals or those with health limitations may require additional support if their ability to earn income is constrained.

- Contributions to the Marriage: Non-financial contributions, such as raising children, managing the household, or supporting a spouse’s career, are also factored into support determinations.

Understanding these criteria allows both parties to anticipate potential obligations or entitlements and plan accordingly.

Different Types of Spousal Support

Spousal support in Massachusetts can take several forms, depending on circumstances:

- Temporary Support: Paid during the divorce process until a final settlement is reached.

- Rehabilitative Support: Helps the receiving spouse gain skills, education, or training to become financially independent.

- Permanent or Long-Term Support: May be awarded in longer marriages or when the receiving spouse cannot achieve self-sufficiency due to age, health, or other factors.

- Lump-Sum Support: One-time payments that may replace ongoing monthly support, often used to settle obligations fully and simplify post-divorce finances.

Knowing the type of support expected can influence budgeting, financial planning, and long-term stability.

Planning for Spousal Support Payments

Understanding how spousal support affects finances is crucial whether you are paying or receiving it. A post-divorce budget should include:

- Monthly support payments owed or received: Ensure you account for both current and potential future payments.

- Taxes and other deductions: Some support payments may have tax implications, and planning ahead can prevent surprises.

- Housing, healthcare, childcare, and daily living costs: Spousal support often interacts with other financial responsibilities.

- Future financial goals: Consider retirement savings, college planning, and other long-term objectives when factoring in support obligations.

Careful planning ensures that support payments are sustainable and that both parties maintain financial stability after divorce.

How a Boston Divorce Financial Planner Can Help

A Boston divorce financial planner provides expertise and clarity in spousal support planning. They can:

- Analyze income and expenses to determine realistic payment or receipt amounts.

- Model multiple scenarios, such as changes in income, remarriage, or adjustments in the duration of support.

- Explain tax implications for both the payer and the recipient.

- Integrate spousal support into broader financial planning, including asset division, budgeting, and long-term investments.

Working with a professional ensures that support decisions are based on accurate financial data rather than assumptions or emotions, providing confidence in post-divorce planning.

Managing Spousal Support Effectively

To manage spousal support successfully:

- Track payments carefully: Maintain accurate records of all support received or paid.

- Review periodically: Income changes, remarriage, or alterations in living arrangements may necessitate support adjustments.

- Plan for taxes: Consult with a tax professional to understand any potential liabilities or deductions.

- Coordinate with other financial decisions: Align support payments with budgeting, investments, and retirement planning to maintain overall stability.

Tips for Individuals Paying or Receiving Support

- Establish a clear understanding of court orders and documentation.

- Factor in potential employment or income changes.

- Keep communication professional and maintain records of all transactions.

- Seek professional guidance for complex situations, particularly when support intersects with child support, business ownership, or retirement planning.

By approaching spousal support methodically, both payers and recipients can avoid confusion, prevent disputes, and protect long-term financial interests.

Conclusion

Spousal support is a critical aspect of many divorces in Massachusetts, and understanding its implications is essential for maintaining financial stability. By evaluating income, expenses, and potential obligations, individuals can plan for both paying and receiving support without jeopardizing long-term goals.

Partnering with a Boston divorce financial planner ensures expert guidance throughout this complex process. Financial professionals provide analysis, scenario modeling, and strategic planning, helping individuals make informed decisions and maintain financial security during and after divorce. With careful preparation, spousal support can be managed effectively, contributing to a smoother transition and greater confidence in one’s post-divorce financial future.